Estimate depreciation on rental property

In our example lets use our existing cost basis of 206000. DailyGuide Can Help You Find Multiples Results Within Seconds.

Depreciation For Rental Property How To Calculate

You should follow the same process for any.

. Landlords can deduct the cost of the building itself certain closing costs and any capital expenditures that improve it or extend its life. So the basis of the property the amount that can be depreciated would be. You also plan on spending an additional 30000 to renovate it before selling.

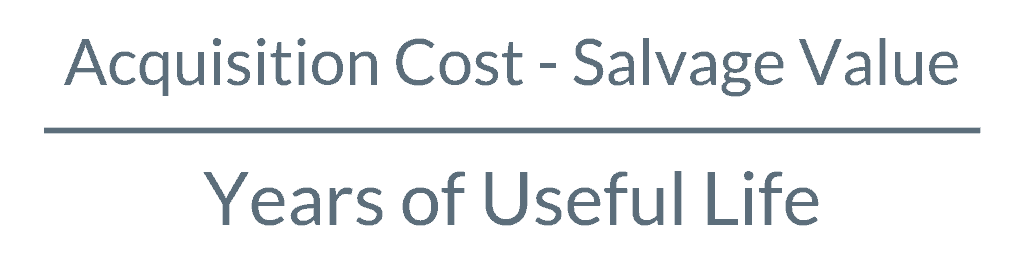

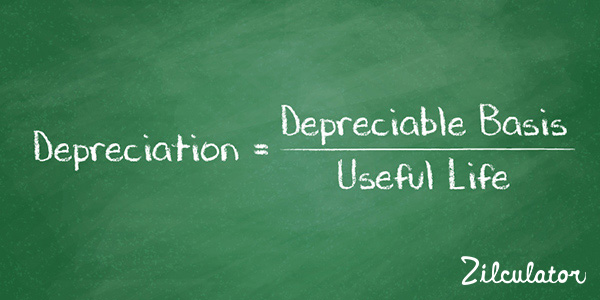

To do it you deduct the estimated salvage value from the original cost and divide by the useful life of the asset. Lets say you paid 200000 for a rental property but its sitting on a 40000 plot of land. We Can Calculate Rent Prices Based On Location and Apartment Size.

Lets say that the original depreciable value of a rental property was 100000 and the investor owned the property for 30 years and all the depreciation 100000 has been used or taken. Calculate The Depreciation Schedule For Rental Property. 100000 cost basis x 1970 1970.

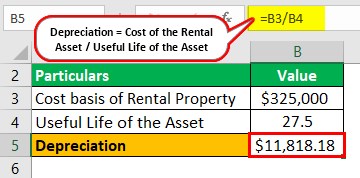

Moreover the property owners and the landlords can benefit by. Ad We Can Help You Bring In Prospective Tenants Too With Our Free Rental Listings. To calculate the annual amount of depreciation on a property you divide the cost basis by the propertys useful life.

Divide Cost by Lifespan of Property. If you own a rental property for an entire calendar year calculating depreciation is easy. The most recent real estate tax assessment values the property at 280000 of which 252000 is for the home and 28000 is for the land.

For residential real estate take your cost base or adjusted cost base if applicable and. Ad Search For Info About Depreciation schedule for rental property. The following process describes how to calculate the depreciation of the rental property based on the purchase of the property.

For this year you would. In this step you take your cost basis from step one and divide it by the years that your rental property is considered to have a useful life. How to use the calculator and app.

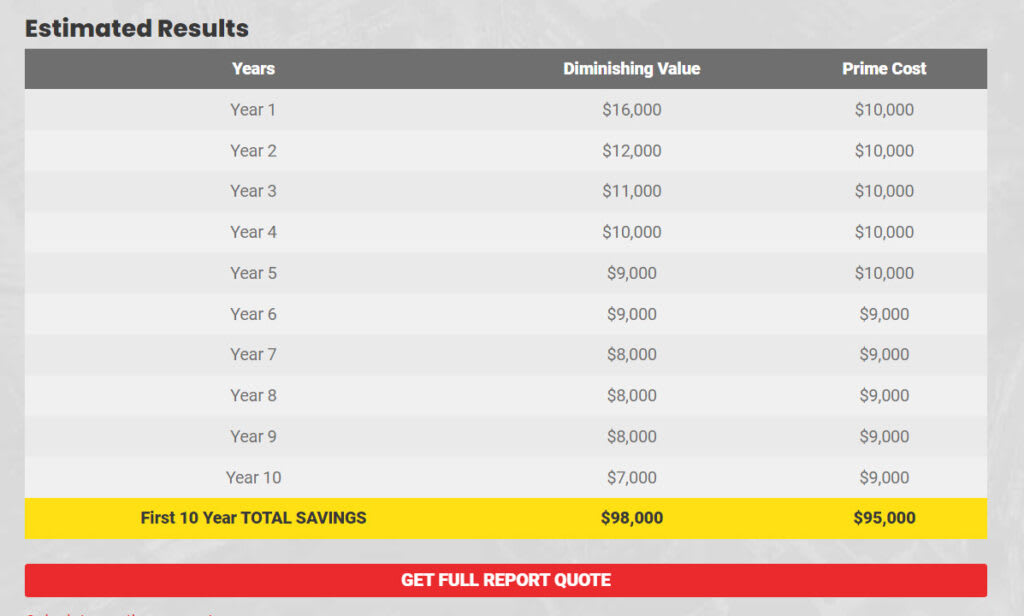

GDS is the most common method that spreads the depreciation of rental property over its useful life which the IRS considers to be 275 years for a residential property. Rental Property Depreciation. For example if a new dishwasher was purchased for 600 had an estimated.

Select Property Type Construction Type Quality of Finish Floor Area Estimated year of Construction Year of Purchase and the Closest Major City to. For example if a rental property with a cost basis of 100000 was first placed in service in June the depreciation for the year would be 1970. Ad Get Access to the Largest Online Library of Legal Forms for Any State.

Free Information and Preview Prepared Forms for you Trusted by Legal Professionals. Now you need to divide the cost basis by the propertys useful life to calculate the annual depreciation on a property. That means if you paid a total of 115000 for a single-family rental home and the land value was 10000 your annual depreciation expense would be 3818 or 3636 of the property value.

Using the above example we can determine the basis of the rental by calculating 90 of 110000. Browse Get Results Instantly. How do you calculate.

Rental Property Appliance Depreciation is the decrease worth of appliances over time. Therefore you can allocate 90. So if you bought a rental property this June with a cost basis of 267000 and started renting it right away.

Real Estate Depreciation Meaning Examples Calculations

Depreciation For Rental Property How To Calculate

Rental Property Depreciation Rules Schedule Recapture

How To Use Rental Property Depreciation To Your Advantage

Straight Line Depreciation Calculator And Definition Retipster

Tax Calculation Spreadsheet Excel Spreadsheets Spreadsheet Budget Spreadsheet

Depreciation Schedule Formula And Calculator Excel Template

Straight Line Depreciation Calculator And Definition Retipster

How To Depreciate A Rental Property Formula Excel Example Zilculator Real Estate Analysis Marketing

How To Calculate Depreciation On Investment Property Wb

Residential Rental Property Depreciation Calculation Depreciation Guru

Residential Rental Property Depreciation Calculation Depreciation Guru

How To Calculate Depreciation On Rental Property

Rental Property Depreciation Calculator Cheap Sale 52 Off Www Ingeniovirtual Com

Rental Property Depreciation Rules Schedule Recapture

How To Calculate Depreciation On A Rental Property

How Much Is A Rental Property The Up Front Recurring Costs